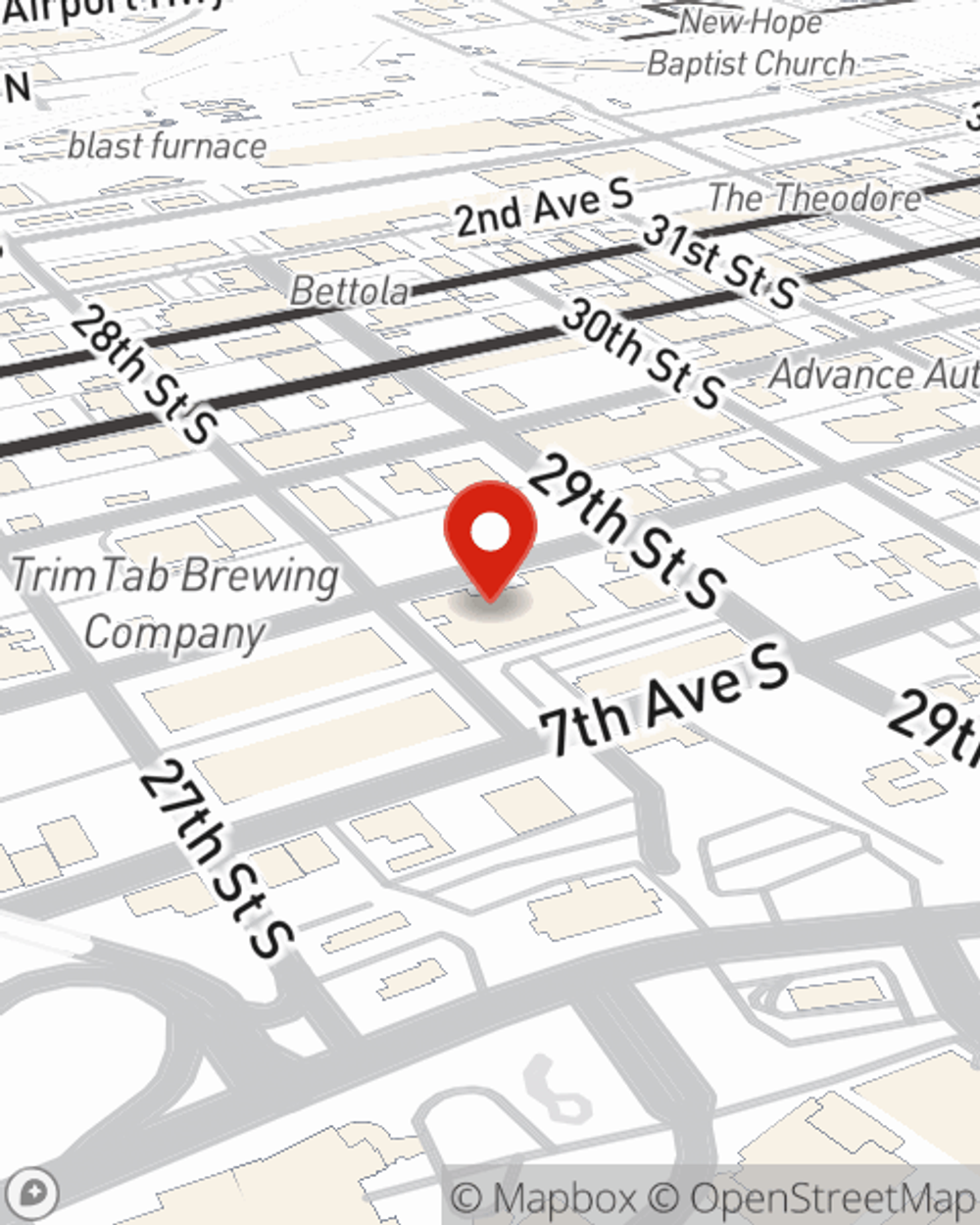

Renters Insurance in and around Birmingham

Get renters insurance in Birmingham

Renters insurance can help protect your belongings

Would you like to create a personalized renters quote?

- Birmingham

- Jefferson County

- Shelby County

- Mountain Brook

- Homewood

- Vestavia

- Cahaba Heights

- St Clair County

- Hoover

- Trussville

- Oak Mountain

- Inverness

- Gardendale

- Fultondale

- Leeds

- Moody

- Highland Park

- Huntsville

- Montgomery

- Atlanta

- Tuscaloosa

- Bessemer

- Irondale

Insure What You Own While You Lease A Home

Think about all the stuff you own, from your bookshelf to couch to boots to camping gear. It adds up! These possessions could need protection too. For renters insurance with State Farm, you've come to the right place.

Get renters insurance in Birmingham

Renters insurance can help protect your belongings

Why Renters In Birmingham Choose State Farm

Renting a home is the right choice for a lot of people, and so is protecting your belongings with insurance. In general, your landlord's insurance might cover repairs for damage to the structure of your rented home, but that doesn't cover the things you own. Renters insurance helps shield your personal possessions in case of the unexpected.

As one of the industry leaders for insurance, State Farm can offer you coverage for your renters insurance needs in Birmingham. Call or email agent Caroline Dorris's office to learn more about a renters insurance policy that can help protect your belongings.

Have More Questions About Renters Insurance?

Call Caroline at (205) 322-3276 or visit our FAQ page.

Simple Insights®

How to throw a safe house party

How to throw a safe house party

Learn tips about hosting a safe party at home, respecting your neighbors when you have parties and minding noise pollution laws.

Portable moving pods: A new approach to moving

Portable moving pods: A new approach to moving

Portable moving pods can offer new advantages for the moving process. Decide what’s easiest and cheapest for you.

Caroline Dorris

State Farm® Insurance AgentSimple Insights®

How to throw a safe house party

How to throw a safe house party

Learn tips about hosting a safe party at home, respecting your neighbors when you have parties and minding noise pollution laws.

Portable moving pods: A new approach to moving

Portable moving pods: A new approach to moving

Portable moving pods can offer new advantages for the moving process. Decide what’s easiest and cheapest for you.